CASH ADVANCE

Your flexible funding service

Unlike a bank loan: fast approval, no fixed monthly repayments and you don't need to prove collateral.

We know running a business isn't always easy

There are always unforeseen expenses around the corner. Maybe you've had supplier problems, or equipment has let you down or even a burst pipe.

On the other hand, maybe you've had a boom in demand and you need to take the next step in growing your business.

That's OK. We have partnered with YouLend to help provide a fast, no-hassle advance for every situation.

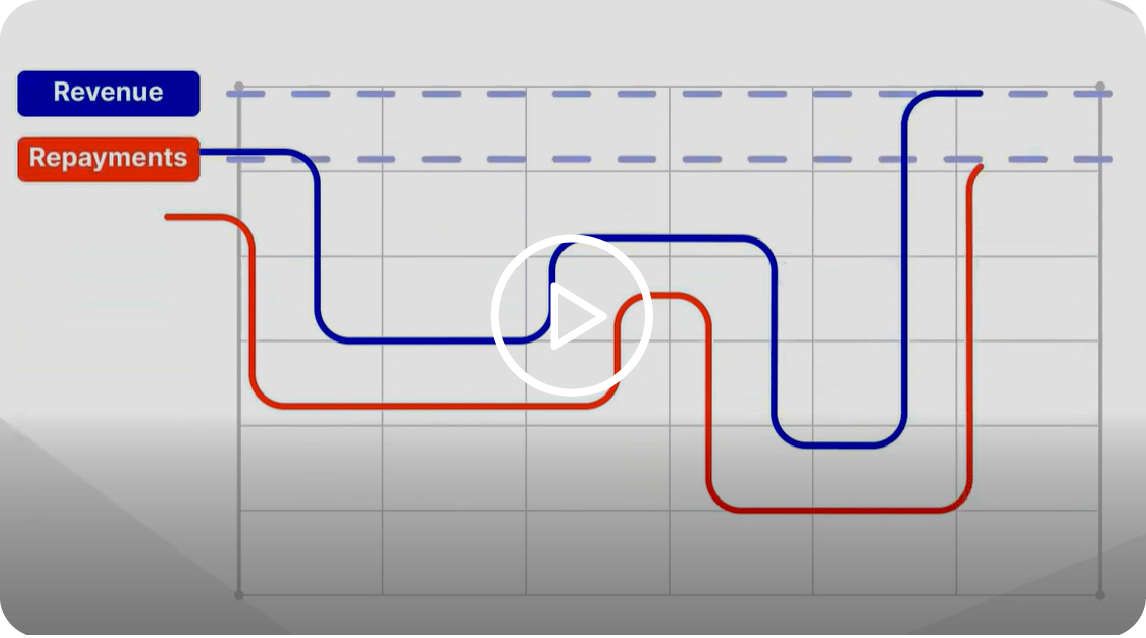

Pay back as you earn

With Cash Advance your business will repay in proportion to your earnings. You can manage your repayments without the pressure. So, if you have a slow day, you will repay a smaller amount.

Funding from £3,000 – £150,000

Whether its a quick fix or big event, you'll be covered. You can borrow up to 150% of your monthly turnover, providing it's in this range.*

*The amount shown above is based on the average value of card transactions processed through your account over the past 6 months. Eligibility criteria will apply. Business must be trading for 3 months or more, with a minimum of £3,000 in card transactions per month. All Cash Advance and Loan Advance applications are processed by our dedicated provider, YouLend Limited T/A YouLend. A soft credit check is required.

"I needed some extra money to refurb my business.

UTP's Cash Advance gave me more flexible repayment options than my bank"

Dean, small business owner

APPLY FOR CASH ADVANCE

FAQ

-

Cash Advance is an alternative to businesses getting a loan from the bank. We offer businesses funding to expand, refurbish or to cover unforeseen costs. Our Cash Advance gives you more flexibility and control over repayments.

-

When it comes to finance, speaking to an advisor before making big decisions is sensible. Registered advisors will be able to walk you through your options and help you make the best decision.

-

Unlike a bank loan, you will not be required to provide collateral to get our Cash Advance.

-

Cash Advance is for small and medium-sized businesses that need a fast and flexible loaning solution. Your business must take card payments as your primary tender.